State Farm Drive Safe & Save Review: A Lot of Tracking, But No Saving

As an Amazon Associate, we earn from qualifying purchases at no cost to you.

A new gadget for my car that can save me money on insurance? Sounds too good to be true, so you can probably tell how this story will end. While State Farm will happily collect your data, they haven’t quite figured out the whole “discount” thing yet.

UPDATE (Nov 2016): This review is for the 2014-version of the program. I’ve been informed that tracking is now done with a smartphone app (instead of the OBD II dongle) and the pricing is now different. However, I would still be wary of how the “discounts” are actually applied to your premium, if they are applied at all.

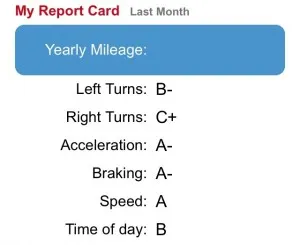

Since my friends tell me I drive way too slow (like a “grandpa”, to be exact), I was intrigued when my local State Farm office sent me a letter stating that my safe driving could save me up to 50% on my insurance premium by subscribing to In-Drive. This service requires that you place a small tracking device in the OBD II data port of your car (most vehicles manufactured after 1996 have one). The device collects things like miles per gallon, your speed around turns, sudden stops, and other details about your driving habits. This information is automatically sent to the In-Drive service via a cellular connection to calculate your discount.

Some people will likely be wary of the fact that the device does contain a GPS chip to track your vehicle’s location. While this could come in handy if your vehicle is ever stolen (and you have a police report to show to In-Drive), this may turn privacy-concerned drivers away from the service.

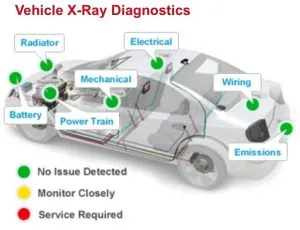

Having nothing to hide about my daily commute to work and home, and the occasional weekend road trip, I signed up for the service and plugged the device into my car. The service immediately provided a diagnostic graphic of my car, showing any potential trouble spots as reported by the car’s onboard computer. It’s kind of like OnStar’s diagnostic reports, but with a lot less detail.

You receive one free year of the In-Drive Basic Service, which at about $72 a year, is seriously lacking. If your check engine light comes on - which the In-Drive device can easily read the code for - it will be kept a secret from you until you pay for the next level of service, which is about $132 a year. If you want to see the approximate location of your vehicle if you lend it to a family member, that requires the premium service as well. And if you call customer service without having a credit card number on file, be prepared to be harassed about that on each and every call.

So I drive along happily while the device uploads my driving stats. Six months go by and the website estimates that I should save about $80 a year. I excitedly wait to see a $40 discount on my six-month renewal, but the bill comes and it is not there. “Not enough data has been collected yet,” is the decree from my State Farm agent. What?? It’s odd that there is “enough data” that the website can throw a big savings number on the screen, but just not enough data to actually reduce my bill. No biggie, I foolishly think to myself. Maybe I’ll see the whole $80 off my next renewal.

After another 6 months of good driving, my bill arrives and only reflects the paltry $40 discount (not the whole $80 that the website constantly displayed throughout the year). Well, my trial is up, so I guess I’ll take it.

That $40 savings is not enough to offset the now $72 per year “privilege” of having State Farm track me, so I call up my agent and cancel the In-Drive service, and then send the device back to In-Drive. Not missing a beat, State Farm sends a bill a few days later for that $40 I had saved. W-what? Is this some kind of joke? My local agent looks into it and replies that the discount is only going forward, not for the driving history I had already earned, therefore, I need to pay my discount back. This contradicts the FAQ posted on State Farm’s website:

How Often is my Safe Driver Discount Calculated When I am Enrolled with Drive Safe & Save?

Your premium is adjusted at each policy renewal period (every six months) and will be based on the information collected from your communication service up to that point.

I doubt I’ll ever see this discount, which is fine. Switching auto insurance (and my housing insurance) in incredibly easy, so State Farm won’t be seeing another payment from this customer who drives well, pays his bill on time, and hasn’t filed a claim for as long as I have been their customer (over 10 years).

If State Farm wants this program to actually be successful, they need to waive the yearly service fee for the basic level In-Drive program, especially since the discounts don’t offset the annual service fee (that is, if you actually ever see the discount). At the basic service level, seeing your miles per gallon stats is about the only useful detail that the In-Drive device will show you, which definitely isn’t worth the $72 a year.

So if you’re a State Farm customer and the In-Drive program rolls out to your state, think twice before enrolling. Forking over your privacy and then fighting to get the discount you earned is probably not worth your time and effort. Instead, your time will be better spent shopping around for a lower rate on your insurance.

UPDATE: A very nice representative from State Farm contacted me to further research my experience with the program. It was a combination of timing and my limited driving distance (which should be a discount in itself, shouldn’t it?) that had led to me losing the discount I had earned. While they made a one-time exception in my case, the representative also informed me that this program was working as it was designed to, so it is possible that others will share my experience. However, I appreciate that State Farm stepped up to get some feedback about the program (and allowed me to vent) and I hope they are able to make improvements to it in the future so that if customers are willing to fork over their privacy, they at least see the discount they deserve.

Hi, I'm Ryan! I've worked in the IT industry for over two decades and I love checking

out new gadgets, apps, and services that make our lives easier.

Hi, I'm Ryan! I've worked in the IT industry for over two decades and I love checking

out new gadgets, apps, and services that make our lives easier.